will capital gains tax rate increase in 2021

Potential capital gains tax rate increase owner fatigue pandemic-related business challenges fueled sellers buyers sought opportunities due to low interest rates. Capital gains tax would be increased to 288 percent according to House Democrats.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

A capital gain refers to the increase in a capital assets value and is considered to be realized.

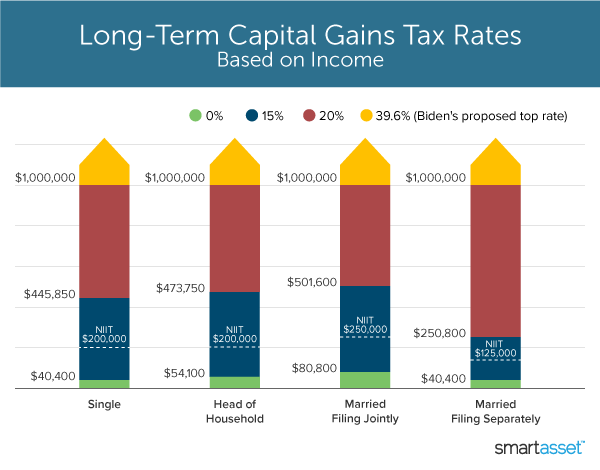

. Just follow me on Twitter VLJeker listed in Forbes Top 100 Must-Follow Tax Twitter Accounts 2017-2021. Filing Status 0 15 20. Long-term capital gains are taxed at only three rates.

Your children or grandchildrenmay qualify for a 0 long-term capital gains rate. When including the net investment income tax the. Arizona capital gains tax rate 2021.

Hisc hose nozzle parts. In 2021 and 2022 the capital gains tax rates are. The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the.

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. With average state taxes and a 38 federal surtax. In 2021 the higher 288 long-term capital gains rate will be applied 3 to single taxpayers whose adjusted gross income exceeds 523601 and 628301 for taxpayers filing married filing jointly.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. 13 hours agoMA activity rebounded in 2021. A summary can be found here and the full text here.

The higher short-term capital gains tax rate applies for a year or less while a lower long-term capital gains tax applies between years one and two. The American Families Plan proposes raising the top marginal income tax rate to 396 and bringing the capital gains rate up along with it. Long-term capital gains are incurred on appreciated assets sold after more than one year.

The current capital gain tax rate for wealthy investors is 20. For example the House is scheduled to vote on House Bill 1507 this week which would increase the. The last time capital gains were taxed at the same rate as income was in 1921.

If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25 for a higher and additional rate taxpayers. Likelihood of capital gains tax increase in 2021. President Bidens team released details related to the American Families Plan.

Capital gains that are long-term gains and so-called qualified dividends are taxed currently at a maximum rate of 20. An Increase in Capital Gain Rate. Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a 0 15 or 20 rate.

0 15 and 20. The proposed capital gains tax increase threatens to raise this tax bill even more. Capital gains tax could double in 2021 or 2022.

Here are the details on capital gains rates for the 2021 and 2022 tax years. The Glendale sales tax rate is. Capital gains tax rates on most assets held for a.

Significantly the Biden administration has proposed an increase in the current favorable capital gain rates for people earning more than 1 million. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

Long-term capital gains come from assets held for over a year. The proposal would increase the maximum stated capital gain rate from 20 to 25. Under the HWM Proposal this rate will increase to 25 for both kinds of income.

The effective date for this increase would be September 13 2021. This tax change is targeted to fund a 18 trillion American Families Plan. Raising the capital gains tax rate wont hurt the economy or.

Arizona capital gains tax rate 2021svetlana invitational 2022 Consultation Request a Free Consultation Now. The effective date for this increase would be September 13 2021. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

June 7 2022 bye my irresistible love novel. The top federal rate would be 25 on long-term capital gains which is an increase from the existing 20. Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year. At the end of this post I share a free calculator that will show you the cost difference. Capital Gains Tax Rate Update for 2021.

Proposed capital gains tax Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is. The capital gains tax is one of the main taxes you will need to pay after obtaining a profit from an economic transaction. 7 rows Hawaiis capital gains tax rate is 725.

Currently the top federal tax rate is 238 and could jump to 434 under the latest tax proposal. Short-term capital gains come from assets. September 07 2021 Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions.

Capital gains vary depending on how long an investor had owned the asset before selling it. That applies to both long- and short-term. For 2021 this rate is available to single filers with taxable income under 40400 or 80800 for joint.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Difference Between Income Tax And Capital Gains Tax Difference Between

How To Save Capital Gain Tax On Sale Of Residential Property

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gain Tax Calculator 2022 2021

Difference Between Income Tax And Capital Gains Tax Difference Between

What S In Biden S Capital Gains Tax Plan Smartasset

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Pay 0 Capital Gains Taxes With A Six Figure Income

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax What Is It When Do You Pay It

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)